The Enduring Allure of Gold

( Definition and Historical Context)

Gold (Au, atomic number 79) is more than just a metal; it is a primal symbol of wealth, durability, and trust. Unlike paper currency, which can be printed endlessly by governments, gold’s supply is finite, making it an intrinsic store of value across millennia and civilizations. Since the earliest coins were struck in Lydia over 2,700 years ago, gold has served as the backbone of economic systems, a medium of exchange, and a universal hedge against political instability and inflation.

For centuries, the concept of the Gold Standard tied national currencies directly to a specific amount of gold, ensuring stability and preventing governments from over-inflating their money supply. Although the global gold standard largely dissolved by the 1970s—when the US formally ended the convertibility of the US dollar to gold—the metal’s significance did not diminish. Instead, it transitioned from a monetary anchor to a highly liquid, non-yielding asset, prized globally as the ultimate “safe haven.” Central banks still hold massive gold reserves, and individual investors turn to it during times of crisis, from market crashes to geopolitical conflicts, cementing its role as a counter-cyclical asset in modern finance. Understanding the forces that currently determine its price requires examining not just supply and demand, but the complex, electronically governed system that replaced the secretive handshake deals of the past.

How the Price of Gold is Calculated and Changing

The price of gold is not calculated by a single authority or government; it is discovered through global, constant trading based on supply, demand, and future expectations. The standard unit of measurement is the Troy Ounce (approximately 31.103 grams), and the global benchmark price is quoted in US Dollars ($/ozt).

-The Historical London Gold Fix

For nearly a century, from 1919 until 2015, the primary global benchmark was the London Gold Fix. This system was notoriously opaque, involving a handful of the world’s leading bullion banks—originally five, including N.M. Rothschild & Sons—meeting twice daily via telephone conference. They would declare their buy and sell orders, and the chair would adjust the price until supply and demand balanced, or “fixed.” This fixed price was then used worldwide by miners, refiners, central banks, and dealers to settle contracts.

-Who Changed This and How the World Accepted It

The traditional London Gold Fix faced mounting criticism over its lack of transparency and regulatory scrutiny, particularly following a global crackdown on the manipulation of other financial benchmarks (such as the Libor scandal). Concerns were raised that the small group of participating banks could potentially manipulate the price for their own gain.

-The Reform in 2015:

In March 2015, the London Gold Fix was officially replaced by the LBMA Gold Price (London Bullion Market Association Gold Price).

- Who Changed It:

The London Bullion Market Association (LBMA), the global authority for the precious metals market, spearheaded the change. The new system is administered by an independent third party, ICE Benchmark Administration (IBA), which provides the auction platform and regulatory oversight.

- How the World Accepted It:

Acceptance was swift and necessary because the LBMA Gold Price is compliant with the international standards set by the International Organization of Securities Commissions (IOSCO), making it a regulated and auditable benchmark. The new electronic auction is transparent, tradeable, and involves a greater number of direct participants, including Chinese and US banks. This transition ensured that the gold market remained compliant with modern financial regulations, which was crucial for its ongoing role in global contracts and central bank valuation.

The Modern Mechanism:

The LBMA Gold Price

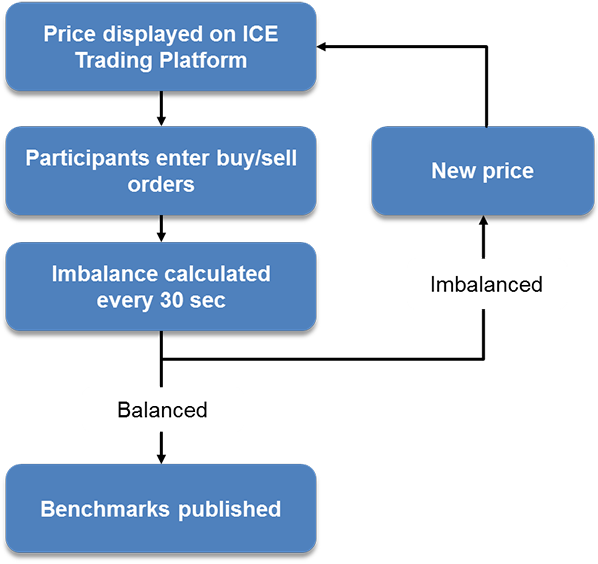

The LBMA Gold Price is determined through a rules-based, electronic, and auditable auction process run twice daily at 10:30 AM and 3:00 PM London time.

- The Process:

IBA announces a starting price close to the current spot market price. - Order Submission:

Participants (global banks and trading firms) submit their buy and sell orders in volumes (troy ounces). - Imbalance Check:

IBA calculates the net imbalance (the difference between total buy volume and total sell volume). - Fixing the Price:

If the imbalance is within a specified, low tolerance (Imbalance threshold (currently 10,000 troy ounces)), the auction ends, and the final price is set. If the imbalance is too large, the price is adjusted, and a new 30-second round begins, repeating until the market reaches equilibrium.

This electronic, anonymous, and auditable process ensures the price accurately reflects the real-time supply and demand of physical gold traded in the London market, making it the most recognized global price reference.

The Dynamics of Change:

Key Factors Affecting Gold Prices

The price of gold is in constant flux, driven by powerful macroeconomic forces that dictate investor sentiment and currency values.

A. The US Dollar (USD) Correlation

Gold is priced in US Dollars globally. Generally, gold and the US Dollar share an inverse relationship.

- Strong Dollar:

When the USD strengthens against other major currencies, it takes fewer dollars to buy an ounce of gold. Simultaneously, for non-US investors (holding Euros, Yen, etc.), gold becomes more expensive in their local currency, suppressing demand and typically pushing the price down. - Weak Dollar:

Conversely, a weakening USD makes gold cheaper for foreign buyers, boosting international demand, and thus raising the dollar-denominated price of gold.

B. Interest Rates and Opportunity Cost

Monetary policy, especially US Federal Reserve (Fed) interest rates, is a critical driver. Gold is a non-yielding asset; it costs money to store and pays no dividend or interest.

- Rising Interest Rates:

When the Fed raises rates, interest-bearing assets like government bonds and savings accounts become more attractive. The opportunity cost of holding gold (the return you give up by not holding the bonds) increases, leading investors to sell gold for cash, which drives the price down. - Falling/Low Interest Rates:

When rates are low, the opportunity cost of holding gold is minimal. Investors prefer gold as a safe store of value compared to bonds yielding little or nothing, which pushes the price up.

C. Inflation and Real Returns

Gold is widely regarded as an inflation hedge.

- High Inflation:

When prices for goods and services rise rapidly, the purchasing power of fiat currencies erodes. Investors rush to gold to protect their wealth, seeing it as a reliable store of value that preserves purchasing power over the long term, causing prices to rise. - Low Inflation:

In periods of stable, low inflation, gold’s appeal as a hedge diminishes, and investors tend to favor growth assets like stocks.

D. Geopolitical Risk and Uncertainty

Gold thrives on fear and uncertainty. Global instability prompts a flight to safety.

- Major Conflicts/Crises: Wars, trade wars, pandemics (like COVID-19), and sudden political crises (like the freezing of central bank assets) cause investors to dump risky assets (stocks) and hoard gold. This safe-haven buying can trigger sharp price rallies.

- Ease of Tensions: When diplomatic talks succeed or major crises abate, investors move money back into riskier, higher-growth assets, leading to a pull-back or crash in the gold price.

Is Gold Rate Artificially Increased? Examining the Geopolitical Angle

The idea that China is artificially increasing the gold price is a persistent, yet largely unfounded, market conspiracy theory. However, China’s actions are undoubtedly the single most significant structural factor driving long-term price appreciation.

-China’s Structural Demand

China is both the world’s largest producer and its largest consumer of gold. Its influence on the market is profound, but it is driven by two key, legitimate forces:

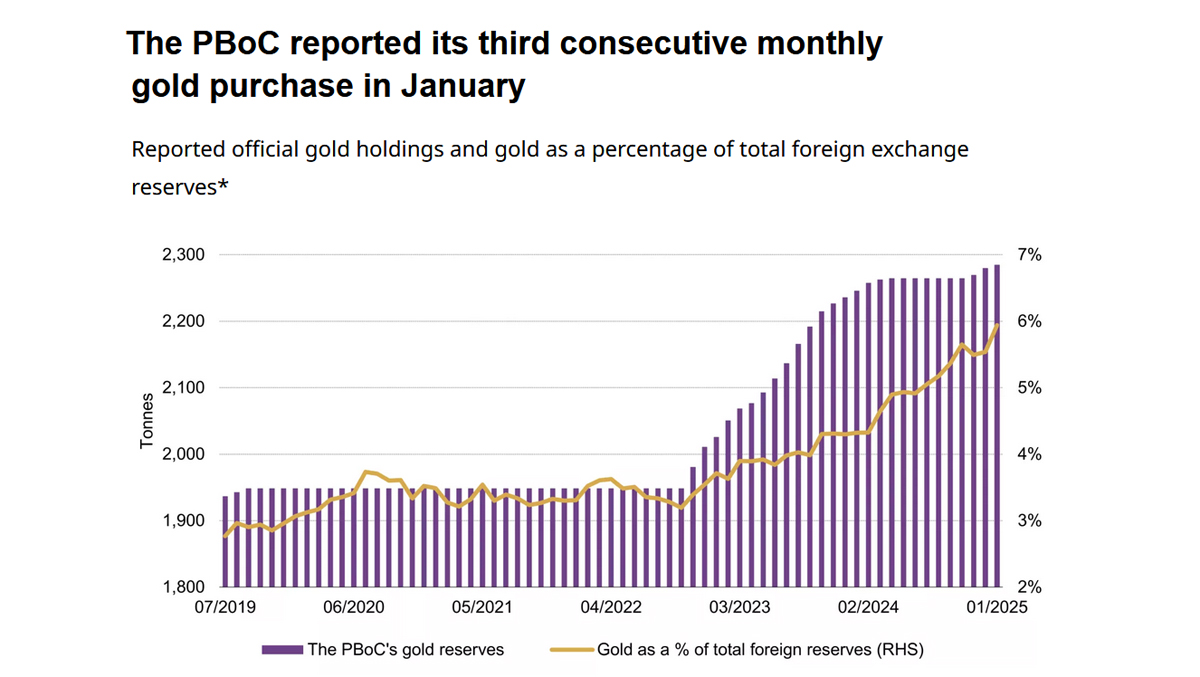

- Central Bank Diversification:

The People’s Bank of China (PBoC) has been a relentless and consistent buyer of gold. Their official gold holdings, while massive, are still significantly low as a percentage of their total foreign reserves compared to Western developed nations (like the US, Germany, or Italy, which hold around 70% of reserves in gold). China is engaged in a long-term, deliberate policy of reserve diversification, primarily aimed at reducing its dependency on the US Dollar. Every 100 tonnes of net gold purchases by central banks worldwide is estimated to correspond to a measurable rise in the gold price. This sustained, non-speculative buying creates a robust price floor. - Household Demand: Chinese households have a deep cultural affinity for gold jewelry and investment, especially during holidays and for wealth preservation. This demand often stabilizes prices, acting as an “opportunistic buyer” floor when prices temporarily dip.

-Conclusion on “Artificial” Pricing

The term “artificial increase” implies illegal market manipulation. While historical price manipulation scandals have occurred (and were the reason for the LBMA reform), the current increase driven by China is structural and market-based. It is the result of a sovereign nation executing a long-term strategic shift in reserve management, transparently buying gold in the open market to diversify away from geopolitical risks, particularly those associated with the US Dollar. This sustained, institutional buying is a fundamental, not artificial, reason for gold’s upward trend.

Reason for Gold Sudden Peek and Crash:

Volatility Explained

Gold is not immune to volatility; in fact, its price action often sees dramatic, sharp moves—both up and down—based on herd mentality, economic data, and technical trading signals.

-Causes of Sudden Peaks (Rallies)

- Black Swan Events:

Unforeseen, high-impact events immediately trigger a flight to quality. Examples include the 2008 Financial Crisis, the initial phase of the COVID-19 pandemic, or the escalation of military conflicts. - Monetary Policy Easing:

When central banks flood the market with liquidity (Quantitative Easing) and announce rate cuts, it signals future

inflation and currency debasement. This is a massive bullish signal for gold, causing speculators and large institutions to pile into long positions, which accelerates the price rise (a “peak”). - Investor Positioning and Short Squeezes:

When a large number of hedge funds and institutional traders place significant long-gold bets on futures exchanges like COMEX, this speculative positioning can drive prices higher extremely fast, creating a parabolic peak.

-Causes of Sudden Crashes (Slumps)

- Profit-Taking and “Bubble” Concerns:

After a prolonged rally, especially one fueled by speculation, traders become highly tempted to liquidate their positions to lock in profits. If this profit-taking starts to “snowball” (as described in one major 2025 slump), it can trigger a sharp sell-off, with prices correcting dramatically in a single day. - Easing Tensions and Strong Economic Data:

If geopolitical risks suddenly disappear (e.g., successful trade negotiations, ceasefires), or if economic data (like employment or GDP growth) is much stronger than expected, it boosts investor confidence in the broader economy. This signals an end to the “safe haven” environment, causing investors to rotate capital out of gold and back into risk assets, leading to a crash. - Strong US Dollar and Rising Real Yields:

A surprisingly hawkish stance from the Fed (promising faster or deeper rate hikes) or a sudden, dramatic strengthening of the US Dollar can immediately hit gold prices, as the opportunity cost of holding the metal surges.

Is the Gold Price Fake?

Market Integrity and Trust

The question of whether the gold price is “fake” usually stems from a distrust of centralized financial systems or an incomplete understanding of how market mechanisms work.

-The Transparency of Modern Pricing

The current pricing system, the LBMA Gold Price, is fundamentally designed to combat the historical issues of price manipulation that plagued the old London Gold Fix.

- Auditable and Electronic:

The electronic auction is auditable, meaning every bid and offer is recorded and timestamped. The methodology is public, rules-based, and compliant with international standards (IOSCO). - Increased Participation:

The number of participating institutions is much larger than the old fix, making collusion statistically more difficult and subject to greater regulatory oversight. - Physical vs. Paper Gold:

It is crucial to distinguish between the spot price (the price for an ounce of unallocated gold in a London vault) and the price of gold derivatives (futures, ETFs, paper gold). While the derivatives market is massive and involves significant speculation, the LBMA Gold Price is anchored to the physical market in London, ensuring that the paper market cannot diverge indefinitely from the cost of the actual physical metal.

-Market Integrity and Regulation

The major gold exchanges, including the LBMA, COMEX (the futures market), and the Shanghai Gold Exchange (SGE), operate under strict regulatory bodies. While manipulation attempts have occurred and been punished (e.g., fines levied against banks for historical rigging), the systems now in place prioritize transparency, minimizing the chance of the price being systematically “fake.”

The price is not “fake”; it is simply volatile and determined by a blend of physical supply/demand and speculative futures trading, all reacting to the constant stream of global economic, monetary, and geopolitical news. The sheer scale of the gold market, estimated to be trillions of dollars, requires genuine buying and selling interest to move the price.

Conclusion:

A Simple Short Final Thought

Gold’s price is a fascinating synthesis of history, economics, and fear. It is no longer set by a few bankers in a room but by a regulated, electronic auction that aggregates global supply and demand. Its value is continuously reshaped by the twin forces of USD strength and global geopolitical uncertainty (where players like China act as major diversification buyers). While subject to speculation and volatility, the benchmark price is transparently set and rooted in the physical reality of a scarce metal, securing its future as the definitive global store of value.

Gold’s price isn’t a fixed number; it’s a real-time global vote on the stability of fiat currencies and the future risk environment.

(Click notification ![]() for more updates)

for more updates)

By: V.Harishram

”Stay true, bring facts to you”