Cryptocurrency has taken the financial world by storm, presenting a new way to think about and use money. From Bitcoin to Ethereum, cryptocurrencies have gained popularity for their potential to disrupt traditional financial systems. However, many people still wonder how cryptocurrencies actually work. This article aims to provide a comprehensive overview of cryptocurrency, explaining its functionality, technology, types, use cases, benefits, disadvantages, and legal challenges.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments (known as fiat currencies), cryptocurrencies operate on decentralized networks based on blockchain technology. This decentralization means that cryptocurrencies are not controlled by any central authority, such as a bank or government, making them resistant to manipulation and censorship.

Who Made This First?

(History)

Cryptocurrency was first created with the invention of Bitcoin in 2009 by an anonymous individual or group known as Satoshi Nakamoto. In the aftermath of the 2008 financial crisis, Nakamoto introduced Bitcoin as a decentralized digital currency designed to bypass traditional banking systems. Bitcoin operates on a blockchain, a public ledger that records all transactions across a distributed network of computers, ensuring transparency and security without needing a central authority.

The concept of Bitcoin solved the double-spending problem, a challenge in digital transactions where the same currency could be spent twice. Nakamoto’s solution, the proof-of-work system, required participants (miners) to solve complex cryptographic puzzles to validate transactions and secure the network. This process also introduced new Bitcoins into circulation as a reward for miners.

Bitcoin’s decentralized nature and transparency quickly attracted attention, leading to the development of thousands of other cryptocurrencies, such as Ethereum and Litecoin, which expanded the use of blockchain technology. Since its creation, Bitcoin has become a symbol of financial independence and technological innovation, laying the foundation for the modern cryptocurrency industry.

How Does Cryptocurrency Work?

At its core, cryptocurrency operates on a technology known as blockchain. Here’s how it works:

- Blockchain Technology:

A blockchain is a distributed ledger that records all transactions across a network of computers. This ledger is maintained by a network of nodes (computers) that validate and record transactions. Each block in the blockchain contains a list of transactions, and once a block is filled, it is linked to the previous block, creating a chain.

- Decentralization: The decentralized nature of blockchain means that no single entity has control over the entire network. Instead, every participant in the network has a copy of the blockchain, ensuring transparency and security.

- Cryptography:

Cryptography is essential for the security of cryptocurrencies. Each user has a pair of cryptographic keys: a public key, which is shared with others to receive funds, and a private key, which is kept secret and used to sign transactions.

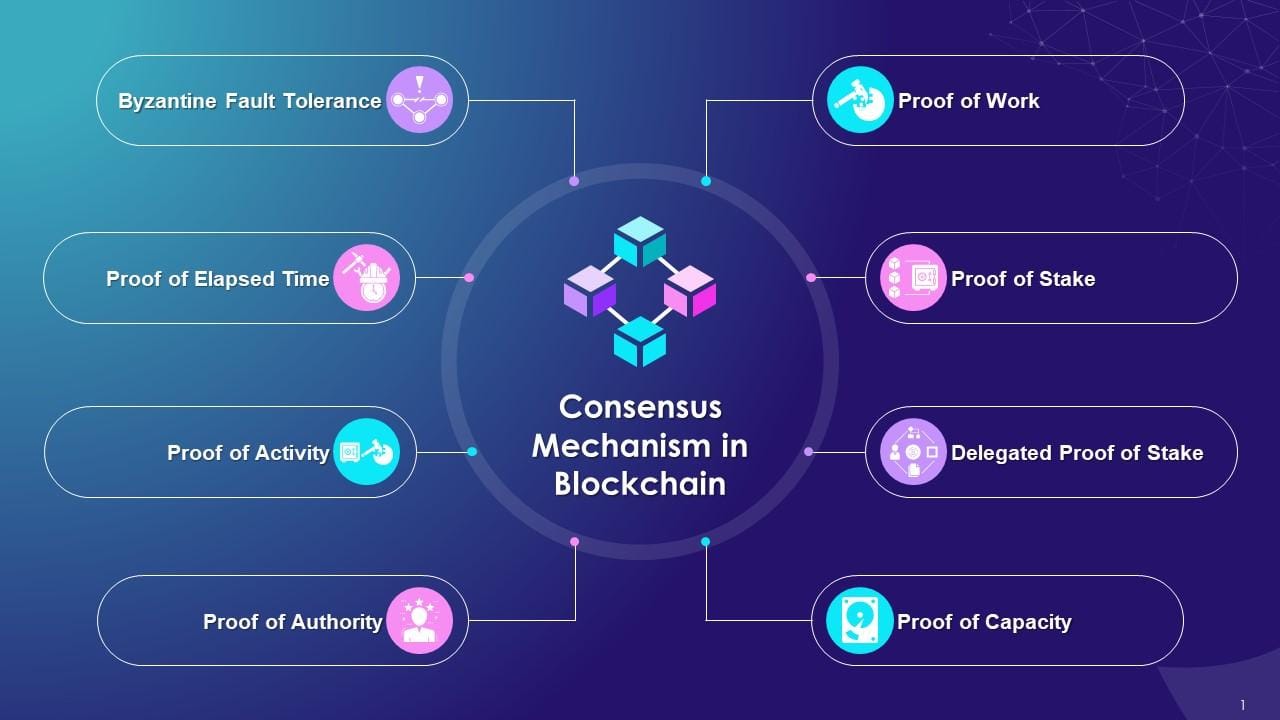

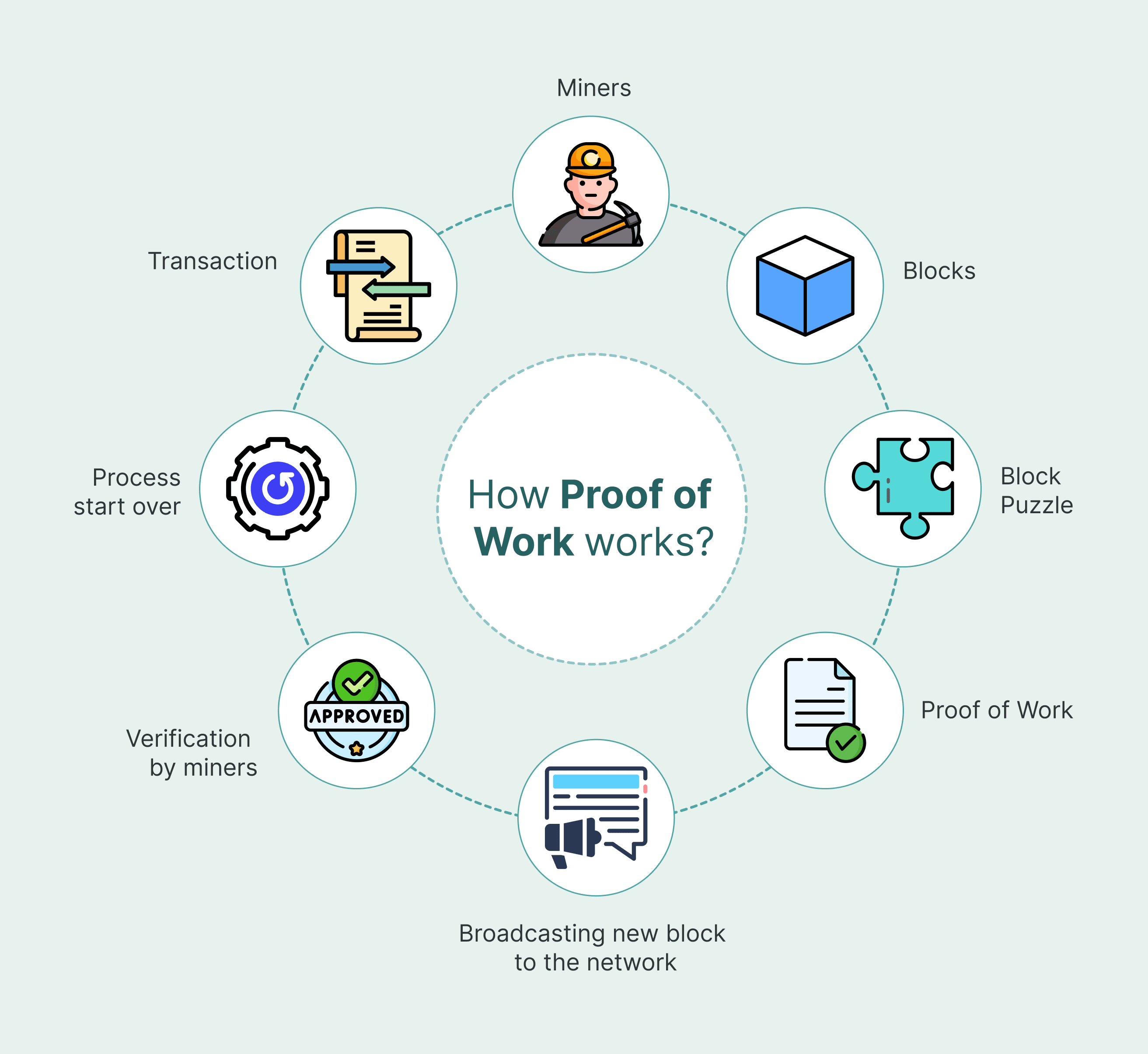

- Mining and Consensus Mechanisms:

Many cryptocurrencies use mining to validate transactions and add them to the blockchain. Miners use powerful computers to solve complex mathematical problems. The most common consensus mechanism is Proof of Work (PoW), where miners compete to validate transactions. Other mechanisms, such as Proof of Stake (PoS), allow users to validate transactions based on the amount of cryptocurrency they hold.

Types of Cryptocurrencies

There are thousands of cryptocurrencies available today, each serving different purposes. Some of the most notable include:

- Bitcoin (BTC):

The first and most recognized cryptocurrency, created in 2009. Bitcoin is often considered digital gold, serving as a store of value and medium of exchange.

- Ethereum (ETH):

A decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Ether (ETH) is the native cryptocurrency used for transactions on the Ethereum network.

- Litecoin (LTC):

Created as a “lighter” version of Bitcoin, Litecoin enables faster transaction processing times and lower fees.

- Stablecoins:

These cryptocurrencies are pegged to traditional assets like the US dollar to minimize price volatility. Examples include Tether (USDT) and USD Coin (USDC).

Use Cases of Cryptocurrency

Cryptocurrencies offer a wide range of applications beyond serving as a medium of exchange. Some notable use cases include:

- Remittances:

Cryptocurrencies can facilitate cross-border transactions with lower fees and faster processing times than traditional banking systems. - Smart Contracts:

Platforms like Ethereum allow for the creation of self-executing contracts with terms directly written into code, automating processes and reducing the need for intermediaries.

- Decentralized Finance (DeFi):

This sector leverages blockchain technology to provide financial services without traditional banks, allowing users to lend, borrow, and earn interest on their crypto holdings.

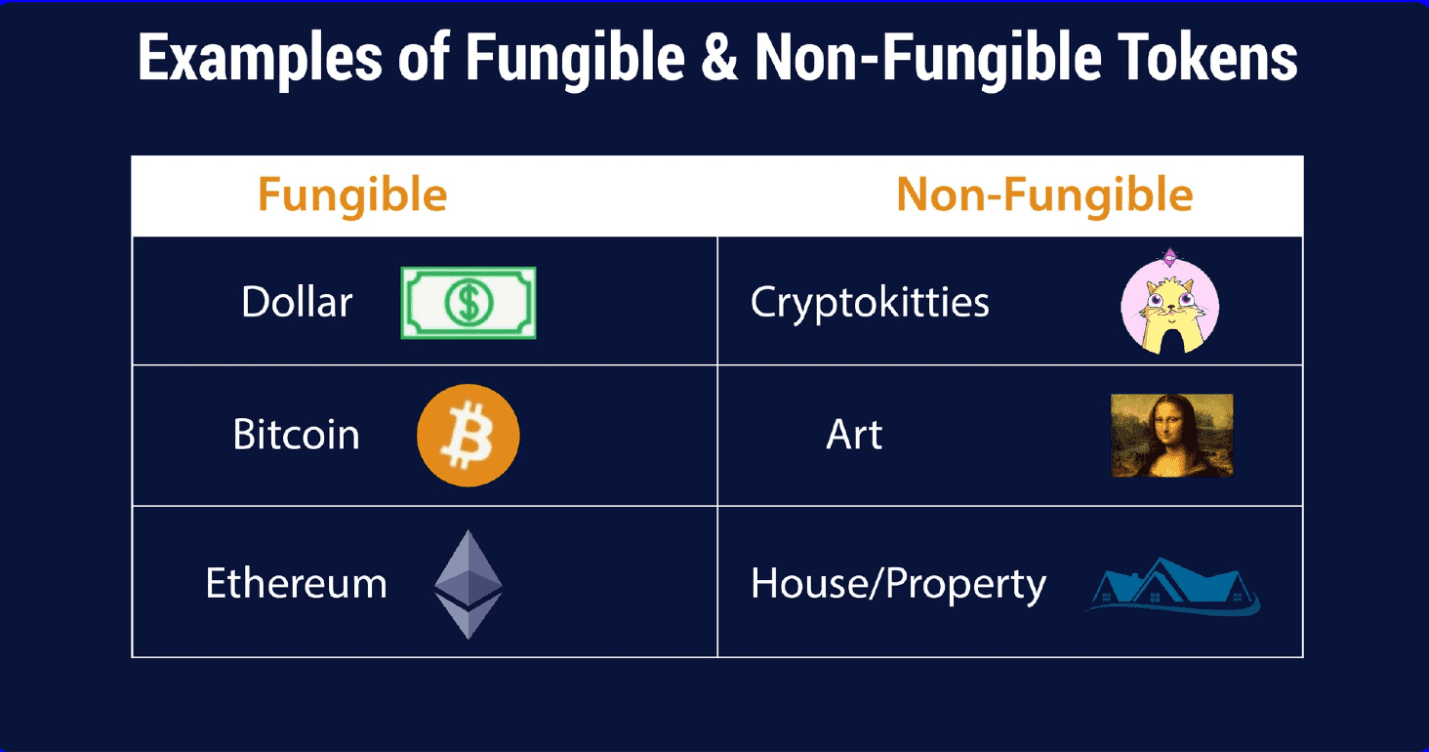

- Non-Fungible Tokens (NFTs):

NFTs represent unique digital assets, such as art or collectibles, revolutionizing ownership and provenance in the digital world.

Will Cryptocurrency Fail?

While the cryptocurrency market is volatile and poses risks, it is unlikely to fail entirely. Cryptocurrencies have demonstrated resilience despite regulatory scrutiny, market crashes, and technological challenges. However, individual cryptocurrencies may fail, especially those lacking a solid use case or community support. Market participants must conduct thorough research and understand the risks involved.

Benefits of Cryptocurrency

Cryptocurrencies offer several advantages:

- Decentralization:

Eliminates the need for intermediaries, allowing peer-to-peer transactions. - Security:

Cryptography and blockchain technology provide robust security measures. - Low Fees: Transaction fees are generally lower than those charged by

traditional financial institutions. - Accessibility: Cryptocurrencies can be accessed and used by anyone with an internet connection, promoting financial inclusion.

Disadvantages of Cryptocurrency

Despite their benefits, cryptocurrencies also come with drawbacks:

- Volatility:

Cryptocurrency prices can be highly volatile, leading to potential financial loss. - Regulatory Concerns:

Governments worldwide are still figuring out how to regulate cryptocurrencies, leading to uncertainty in the market.

https://www.sec.gov/securities-topics/crypto-assets

- Scalability Issues:

Many cryptocurrencies face challenges regarding transaction speed and scalability, particularly during peak demand periods. - Security Risks:

While blockchain is secure, exchanges and wallets can be vulnerable to hacks and theft.

Legal Problems

The legal landscape surrounding cryptocurrency is complex and constantly evolving. Issues include:

- Regulatory Uncertainty:

Governments are grappling with how to classify and regulate cryptocurrencies, leading to varying legal frameworks worldwide. - Taxation:

In many jurisdictions, cryptocurrencies are considered assets for tax purposes, leading to potential tax liabilities for users. - Fraud and Scams:

The rise of cryptocurrencies has led to an increase in fraudulent schemes, including Ponzi schemes (Ponzi schemes use new investors money to pay earlier ones )and fake ICOs (Initial Coin Offerings).

Conclusion

Cryptocurrency represents a significant shift in how we think about money and transactions. By leveraging blockchain technology, cryptocurrencies offer a decentralized, secure, and efficient alternative to traditional financial systems. While they come with their own set of challenges and risks, their potential applications and benefits make them an exciting area for exploration. As the legal landscape continues to evolve and technology advances, cryptocurrencies are likely to play an increasingly important role in the global economy, reshaping the way we conduct transactions and interact with financial systems.

Artical written by V.Harishram